Originally published in The Forum of Fargo-Moorhead, May 28, 2016

By Grace Lyden

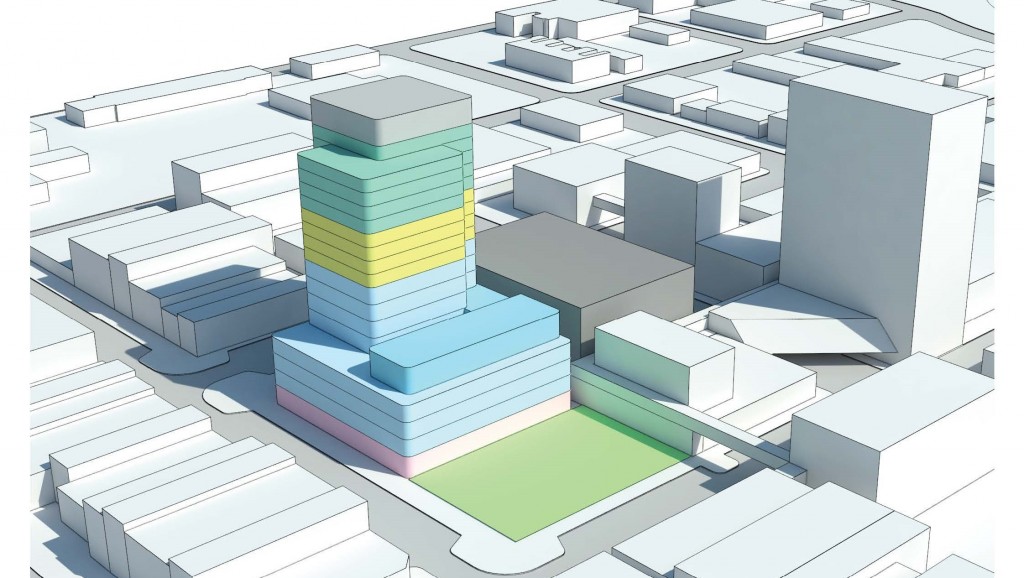

On split votes, city commissioners on Monday approved $15.5 million in tax incentives for the 18-story downtown Fargo high-rise expected to start construction this year and be finished by 2019.

But that $15.5 million in tax help, which taps three different types of incentives the city offers, isn’t all the same, and it’s not all tax exemptions.

A little more than half, $8 million, is property taxes that the developer won’t have to pay. The remaining $7.5 million is property taxes that will be paid, but which will go toward paying for parts of the project that the city is initially bankrolling, because they have a public benefit.

Here’s how it divvies up, according to Jim Gilmour, Fargo’s city planning director:

The tax exemptions are through the city’s Renaissance Zone and payment in lieu of taxes (PILOT) programs, which start in 2019.

The downtown Renaissance Zone exempts Block 9’s hotel, retail and office spaces from paying property taxes for the first five years, a savings of $2 million. The PILOT exempts the hotel, retail and office spaces from paying property taxes for the 15 years after that, a savings of $6 million.

The other $7.5 million comes from 25 years of tax increment financing (TIF), mostly from the condos in Block 9. Property taxes paid through TIF will go toward paying off the $15 million the city is borrowing to build a public plaza outside the high-rise and an attached parking garage, which will only be available to the public during nights and weekends.

Though city financing for the plaza and the ramp is capped at $15 million, the cost might be $2 million more. The high-rise developers are responsible for picking up the tab on anything more than $15 million.

For the two years of construction, all of Block 9 will pay property taxes into the TIF. After construction, only the condo owners will do so. In 2039, the rest of Block 9 will also start paying property taxes toward the $7.5 million, and the TIF will end in 2042.

To pay off the rest of its debt, the city is selling the parking garage to the developer, which will make payments over 20 to 25 years totaling $19.5 million. That’s a total of $27 million for the city from condo owners and the three companies jointly developing the property-TMI Hospitality, RDO Equipment Co. and Kilbourne Group.

Read also: 9 things to know about Block 9, Fargo’s future downtwon high-rise, by Grace Lyden, Fargo Forum, May 27, 2016